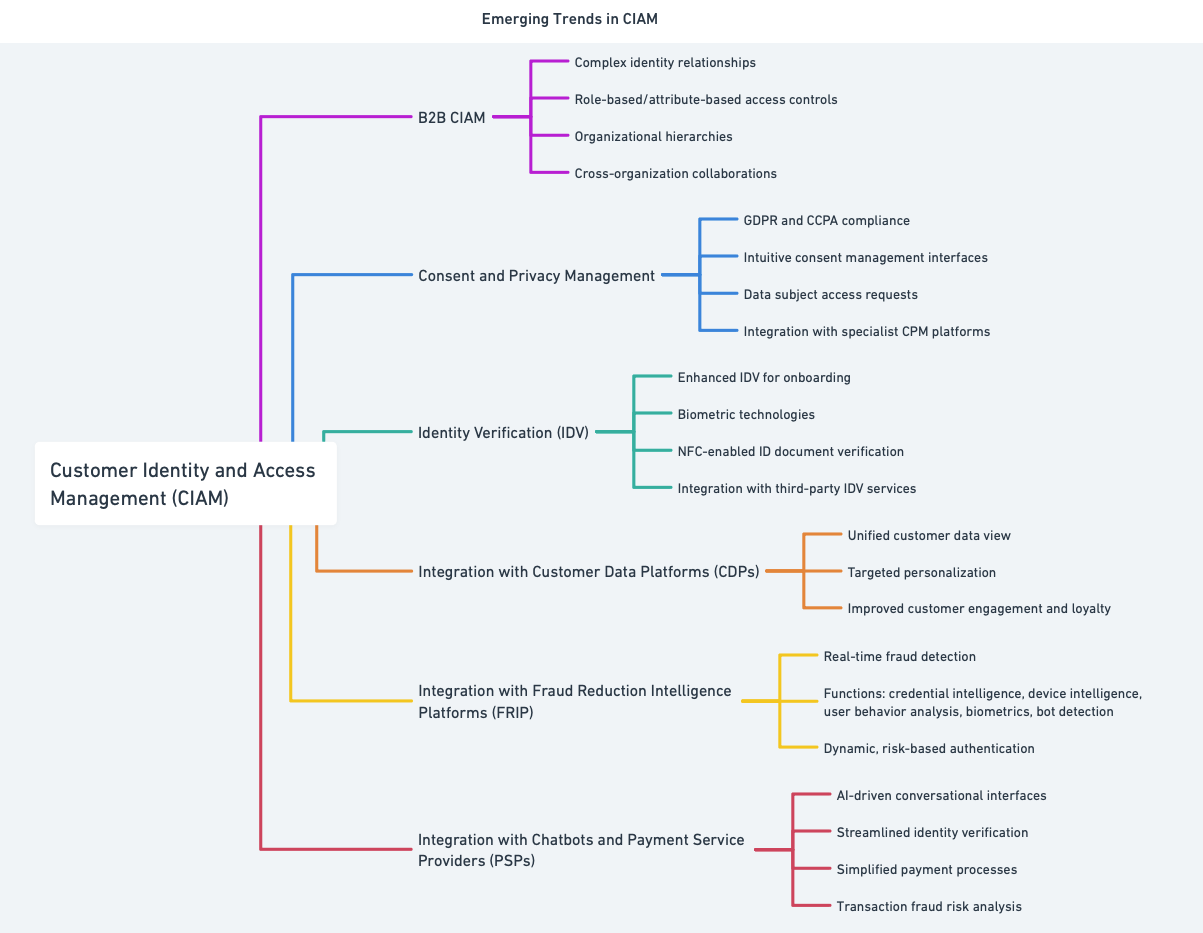

The field of Customer Identity and Access Management (CIAM) continues to evolve as businesses seek to enhance user experiences while improving security and compliance with regulations, particularly privacy regulations. Emerging trends in CIAM are driven by heightened consumer expectations and the technological advancements reshaping how businesses interact with their customers. In this article, we will examine some significant trends we see in CIAM, particularly focusing on Business-to-Business (B2B) CIAM, consent and privacy management, identity verification, and integration with customer data platforms, Fraud Reduction Intelligence Platforms, chatbots, and payment service providers.

B2B CIAM

Organizations in supply chains with complex business relationships (such as partners and contractors) as well as pure business-to-business customer relationships are increasingly turning to CIAM systems to manage digital identities and provide access controls to sensitive resources. Unlike Business-to-Consumer (B2C) environments, B2B interactions often require managing complex identity relationships that span across multiple organizational boundaries. B2B CIAM solutions focus on providing secure access to resources for those business partners, suppliers, and contractors. This often involves complex identity relationships and role-based or, better yet, attribute-based access controls that support organizational hierarchies and cross-organization collaborations. The shift towards more sophisticated B2B CIAM solutions allows companies to manage these intricate relationships efficiently, improving security and compliance. B2B CIAM features facilitate secure and efficient access to shared resources and services, which also optimizes operational efficiency.

Consent and Privacy Management

Consent management has been a key part of CIAM offerings since the advent of GDPR and CCPA a few years ago. Effective CIAM systems provide users with the ability to manage consent collection, and interfaces for data subject access requests, personal data editing, and data deletion. Organizations are increasingly looking to CIAM solutions that provide users with intuitive interfaces for consent management, enabling them to easily toggle their preferences and manage their own data footprint actively. Organizations that adopt CIAM solutions that prioritize privacy and consent management will likely stand out as leaders in customer trust and satisfaction.

Moreover, specialist consent and privacy management (CPM) platforms have arisen that offer enhanced features that work across CIAM solutions and associated data stores. Vendors in the CIAM space have started to offer more integrations with these third-party CPM platforms. Companies and organizations that operate in the EU and other jurisdictions with strict privacy laws may need connectors between their CIAM and CPM.

Identity Verification (IDV)

Digital transformation has increased the emphasis on secure and accurate identity verification within CIAM systems for customer onboarding. IDV processes and technologies are needed for use cases that require higher than standard identity assurance levels, such as in banking and finance as well as in other verticals like travel and hospitality and certain types of companies that offer equipment or housing rentals. Modern CIAM solutions are integrating advanced identity verification technologies such as biometrics to enhance accuracy and reduce friction in the verification process. This allows businesses to streamline the onboarding process, improve security, and enhance the user experience by reducing the need for cumbersome in-person registration or error-prone video identification.

Remote IDV services usually leverage a mobile phone-based app that can match selfies against photos on official identity documents. The most effective IDV apps also use NFC to read chips in those documents. This level of rigor is needed to deter the escalating wave of AI-powered enrollment time attacks.

While some vendors in CIAM have these capabilities within their own solutions, it is more common that they provide integrations with third-party IDV service providers. IDV services are often regionally constrained, so organizations that operate across many countries may need to look for CIAM providers that have connectors for all the relevant IDV services.

Integration with Customer Data Platforms (CDPs)

Another trend that is slowly catching is the integration with Customer Data Platforms (CDPs). This integration facilitates a unified view of customer data, enabling better insights into customer behavior and preferences. By bridging CIAM with CDPs, organizations can leverage data for targeted personalization, enhancing customer engagement and satisfaction through tailored experiences. This should enable organizations with both CIAM and CDP to deliver targeted marketing campaigns, improve customer service, and solidify customer loyalty.

Integration with Fraud Reduction Intelligence Platforms

Fraud prevention is a necessary component of modern CIAM solutions. All kinds of businesses, governments, and even non-profits are dealing with more Account Takeover (ATO) attacks, New Account Fraud (NAF), and synthetic fraud. Institutions in the financial sector and merchants of all types are also fighting against transaction fraud. The integration of Fraud Reduction Intelligence Platforms (FRIP) with CIAM helps organizations detect and mitigate fraudulent activities in real-time. FRIP solutions have six primary functions: identity verification (mentioned above), credential intelligence, device intelligence, user behavioral analysis, behavioral biometrics, and bot detection and management. FRIP systems analyze behavioral patterns, contextual data, and transactional details in real time, leveraging advanced analytics and machine learning to identify and prevent fraudulent activities. When integrated with CIAM systems, FRIPs can pull in the necessary identity data to help make real-time fraud risk determinations. This integration supports dynamic, risk-based authentication and adaptive access control within the target CIAM system. By combining CIAM with FRIP, organizations can more effectively mitigate fraud, build customer trust, and comply with regulations.

Integration with Chatbots and Payment Service Providers

A small number of CIAM providers have integrations with chatbot services and Payment Service Providers (PSPs). Chatbots powered by AI have the potential to enhance the user experience by deploying conversational interfaces that are capable of addressing user queries, facilitating registration processes, and assisting in identity verification processes. Chatbots may be able to provide faster assistance and to handle routine inquiries efficiently. However, experiences with chatbots have been less than optimal so far.

A few CIAM systems offer tie-ins to PSPs in order to streamline transaction fraud risk analysis and processing. The integration with PSPs can simplify payment processes for both merchants and users.

Emerging Trends in CIAM map

Conclusion

The CIAM landscape continues to evolve, driven by the need for enhanced security, personalization, and compliance. Join us at EIC in May to see and hear more about CIAM. We will have sessions on customer identity and fraud protection, and vendors will be showcasing their products. We hope to see you there!