KuppingerCole's Advisory stands out due to our regular communication with vendors and key clients, providing us with in-depth insight into the issues and knowledge required to address real-world challenges.

Unlock the power of industry-leading insights and expertise. Gain access to our extensive knowledge base, vibrant community, and tailored analyst sessions—all designed to keep you at the forefront of identity security.

Get instant access to our complete research library.

Access essential knowledge at your fingertips with KuppingerCole's extensive resources. From in-depth reports to concise one-pagers, leverage our complete security library to inform strategy and drive innovation.

Get instant access to our complete research library.

Gain access to comprehensive resources, personalized analyst consultations, and exclusive events – all designed to enhance your decision-making capabilities and industry connections.

Get instant access to our complete research library.

Gain a true partner to drive transformative initiatives. Access comprehensive resources, tailored expert guidance, and networking opportunities.

Get instant access to our complete research library.

Optimize your decision-making process with the most comprehensive and up-to-date market data available.

Compare solution offerings and follow predefined best practices or adapt them to the individual requirements of your company.

Configure your individual requirements to discover the ideal solution for your business.

Meet our team of analysts and advisors who are highly skilled and experienced professionals dedicated to helping you make informed decisions and achieve your goals.

Meet our business team committed to helping you achieve success. We understand that running a business can be challenging, but with the right team in your corner, anything is possible.

Fraud is a major cost to businesses worldwide and this has been exacerbated by the worldwide Covid pandemic. Banking, finance, payment services, and retail are some of the most frequent targets of fraudsters. However, insurance, gaming, telecommunications, health care, cryptocurrency exchanges, government assistance agencies, travel and hospitality, and real estate are increasingly targeted as cybercriminals have realized that most online services trade in monetary equivalents. After years of being the focus of cybercriminals, banking and financial institutions are more likely to be better secured than other industries, meaning that fraudsters are increasingly likely to attack any potentially lucrative target if given the opportunity. Fraud perpetrators are continually diversifying and innovating their Tactics, Techniques, and Procedures (TTPs).

The most prevalent types of fraud businesses, non-profit organizations, and government agencies experience today are:

Many other types of online fraud exist and they continue to proliferate and evolve. Examples are listed below based on categories:

Phishing/Smishing/Vishing threats, many of which can be perpetrated by bots:

Issuer issues:

Website operator issues, most of which are caused by bots:

Cryptocurrency

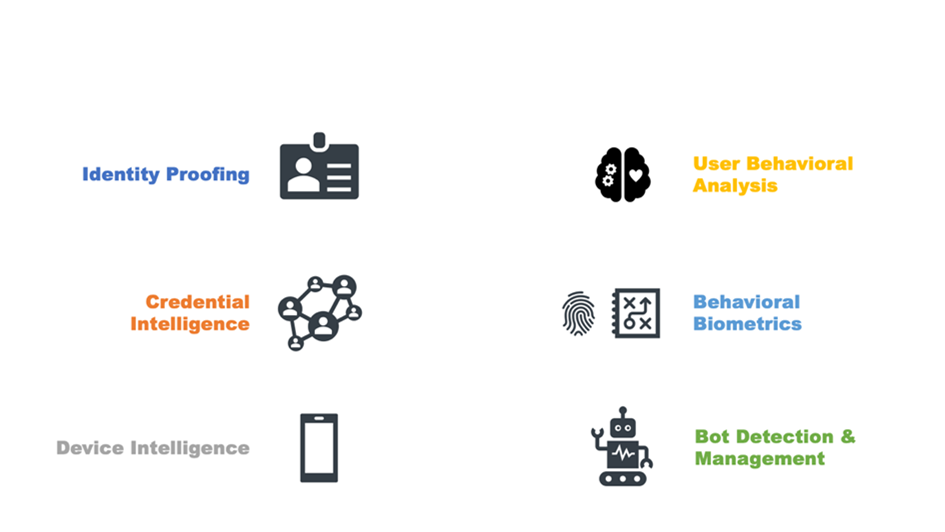

The chief mitigation strategies against these types of fraud employ real-time risk analytics and decisioning. Risk-based Multi-Factor Authentication (MFA) can eliminate a substantial portion of ATOs by increasing authentication assurance levels. Risk-based MFA often evaluates credential intelligence, device intelligence, user behavioral analytics, and behavioral/passive biometrics. To decrease NAF/AO/Synthetic Fraud, increasing identity assurance at registration and authentication time with identity vetting services are recommended. Bot detection and management can also be helpful at cutting other types of fraud.

Risk-based MFA and transaction processing solutions operate optimally when integrated with or informed by Fraud Reduction Intelligence Platforms (FRIPs). FRIPs provide to risk-based MFA and transaction processing systems the information needed to make more accurate decisions on whether or not transactions should execute. FRIP solutions generally provide up to six major functions:

Figure 1: The Six Major Fraud Reduction Techniques